Key Takeaways

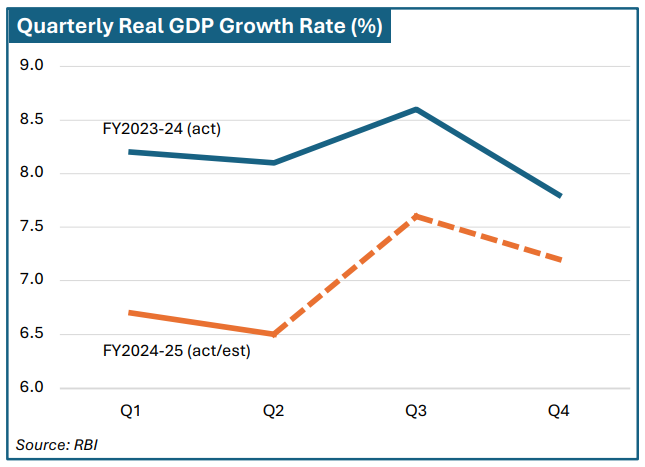

- Robust GDP Growth Projections: India’s real GDP growth moderated to 6.5 percent in Q2 of FY2024-25 from 6.7 percent in Q1. While oEicial RBI data is awaited, the RBI forecasts GDP growth at 6.7 percent in Q2 and an acceleration to 7.6 percent in Q3 FY2024-25, indicating continued economic momentum supported by domestic demand and favorable agricultural performance.

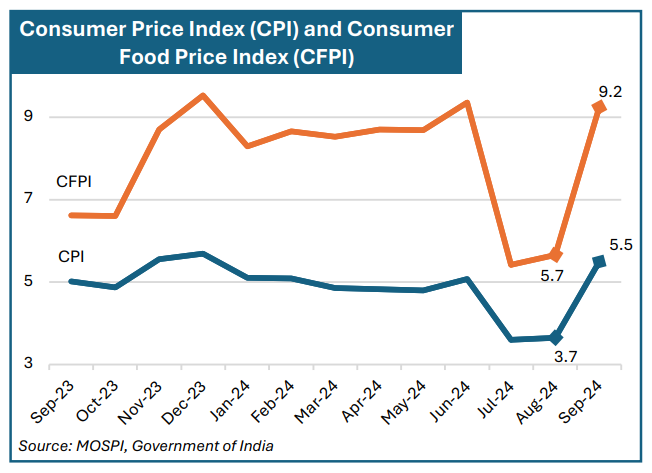

- Inflation Dynamics Reflect Volatility: Inflation trends in Q2 FY2024- 25 showed a mixed pattern, with headline inflation moderating to 3.6 percent in July but surging to 5.5 percent in September due to rising food prices and weather-related disruptions. Core inflation, excluding food and fuel, increased to3.6 percentin September, signaling underlying price pressures.

- Monetary Policy Maintains Neutral Stance: In October, the RBI kept the repo rate unchanged at 6.5 percent and adopted a ‘neutral’ stance. This approach aims to align inflation with growth targets while addressing near-term inflationary pressures from food price volatility and global commodity fluctuations, emphasizing the importance of flexible policy measures in maintaining economic stability.

- Resilient Manufacturing and Services Sectors: Both sectors maintained PMI readings above the critical50-point threshold, signaling continued expansion at 56.5and 57.7 respectively in September reflecting sustained growth despite a gradual slowdown in July and August, still indicating robust expansion driven by strong domestic demand, though facing challenges from rising input costs and increased competition.

Meghna Chadha

Senior Economic Researcher

mchadha@staging-builder.usispf.org

Malachy Nugent

VP, Financial Services & Head of Research

mnugent@staging-builder.usispf.org

With contributions from:

Divdrisht Singh

Associate, Programmes and Financial Services

Deepak Joshi

Senior Director, Financial Services

- Improved Fiscal Position Supports Growth:India’s fiscal deficit improved to 29.4 percent of the budget estimate in the first half of FY2024-25, down from 39.3 percent in the same period last year. This improvement was driven by robust tax revenues, including strong income tax and GST collections, and disciplined expenditure management. The stable fiscal position supports continued investment in growth and welfare priorities, ensuring fiscal prudence alongside economic expansion.

- In Focus – Bond Markets: India’s bond market achieved record corporate bond mobilization of approximately USD 1.20 trillion in FY2023-24, a17 percent increase over the previous year. Foreign investments in debt markets exceeded USD 12 billion in 2024, highlighting strong investor confidence and the bond market’s crucial role in funding economic growth.

Recent Economic Performance

India’s economy continues to demonstrate robust performance across various sectors, with key indicators reflecting sustained growth and stability.

Growth

The global economy has shown resilience amidst intensifying geopolitical conflicts and is expected to maintain stable momentum through the remainder of the year. In India, the fiscal year began on a positive note, with real GDP growing by 6.7 percent in Q1 FY2024-25, driven by strong private consumption and investment activities. Growth in the second quarter, however, is estimated to have moderated slightly to 6.5 percent year-on-year (YoY), as projected by ICRA, an investment information and credit rating agency. While official data from the Reserve Bank of India (RBI) is awaited, the RBI’s Economic Activity Index (EAI), which tracks high-frequency indicators, forecasts real GDP growth at 6.7 percent in Q2 and an acceleration to 7.6 percent in Q3 FY2024-25.

The agriculture sector is poised for robust performance, supported by above-normal monsoon rainfall and strong reservoir levels, which are expected to enhance agricultural output. The manufacturing and services sectors are also likely to remain stable, contributing to overall economic momentum.

On the demand side, healthy kharif (monsoon season) crop sowing and sustained consumer spending during the festive season are expected to boost private consumption, which is likely to emerge as a key driver of growth in Q3. Improved consumer and business confidence further strengthen the economic outlook. The investment climate continues to benefit from growth in non-food bank credit, i.e., bank credit extended to sectors excluding food procurement. High capacity utilization, strong balance sheets in banks and corporates, and the government’s consistent focus on infrastructure development further support investment activity. External demand may gain from improving global trade volumes, though the potential escalation in US tariffs could pose short-term challenges to export performance.

Inflation

Inflation trends during Q2 FY2024-25 reflected a mix of easing pressures early in the quarter and renewed momentum by September. Headline consumer price inflation (CPI), moderated to 3.6 percent in July 2024, down from 5.1 percent in June, as food and fuel prices softened. However, inflation edged up to 3.7 percent in August and sharply rose to 5.5 percent in September, driven by higher food prices, weather-related disruptions, and seasonal factors. The broad-based rise across food, fuel, and core categories highlights the underlying price pressures.

Consumer food price inflation (CFPI) rebounded sharply, rising from an average of 5.2 percent in July–August to 9.2 percent in September, fueled by significant increases in vegetable, milk, and non-alcoholic beverage prices. However, moderation in the price of cereals, meat, eggs, pulses, and sugar tempered some of the upward momentum. Edible oil prices moved out of deflation after 19 months, while deflation in spice prices deepened. Food price inflation was slightly higher in urban areas (9.6 percent) than in rural areas (9.1 percent).

Fuel price inflation remained in deflationary territory for the twelfth consecutive month but narrowed from -5.3 percent in August to -4 percent in September. This narrowing was driven by slower deflation in LPG prices and a slight uptick in electricity inflation to 5.4 percent. Prices of firewood and chips also contributed to the narrowing deflationary trend, although kerosene returned to deflation.

Core inflation, which excludes food and fuel, averaged 3.4 percent in July–August and rose to 3.6 percent in September. Increases were observed in housing, transport, and personal care categories, reflecting persistent underlying price pressures. Meanwhile, sub-groups such as recreation, education, and intoxicants showed moderated price growth.

In response to these evolving economic conditions, the Monetary Policy Committee (MPC) decided in its October meeting to keep the policy repo rate unchanged at 6.50 percent. Consequently, the standing deposit facility (SDF) rate remains at 6.25 percent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 percent. The MPC shifted its policy stance to ‘neutral,’ emphasizing inflation alignment with growth. It acknowledged that macroeconomic parameters of inflation and growth are well-balanced, but the anticipated rise in headline inflation calls for vigilant monitoring.

Agricultural Sector and Monsoon Impact

Cumulative rainfall during the current Southwest Monsoon season has been 8 percent above the Long Period Average (LPA), compared to 6 percent below LPA during the corresponding period last year. This favorable monsoon supported agricultural growth, with total kharif sowing reaching 110.9 million hectares as of September 27, 2024—1.9 percent higher than last year and 1.7 percent higher than the normal area. Major crops such as rice, pulses, coarse cereals, oilseeds, and sugarcane saw increased acreage, although cotton acreage declined.

All-India water storage in 155 major reservoirs stood at 88 percent of total capacity as of October 3, 2024, significantly higher than 74 percent a year ago and the decadal average of 77 percent. These conditions bode well for the upcoming rabi (winter) planting season. However, vegetable production declined by 3.2 percent in 2023-24 due to reduced production of onions (-19.7 percent) and potatoes (-5.1 percent), while tomatoes and non-TOP (tomato, onion, potato) vegetables increased. This shortfall in key crops may exert upward pressure on food prices.

Manufacturing and Services Sectors

India’s manufacturing and services sectors continued to demonstrate resilience during Q2 FY2024- 25, as indicated by strong Purchasing Manager’s Index (PMI) readings. Both sectors recorded PMI levels above the critical 50-point threshold, signaling expansion, although at a decelerating rate compared to earlier highs.

The Manufacturing PMI stood at 56.5 in September 2024, reflecting sustained expansion despite moderation from 58.1 in July and 57.5 in August. Factory output and sales growth softened for the third consecutive month, with international orders expanding at their slowest pace in 18 months. Input cost pressures rose moderately due to higher prices of chemicals, packaging, and metals. However, businesses maintained healthy employment levels and purchasing activity, highlighting confidence in robust domestic demand. India has consistently maintained its position as the top-performing major economy in PMI rankings for manufacturing since July 2022.

The Services PMI also indicated expansion, with a reading of 57.7 in September 2024, though lower than the 60.9 recorded in August. Growth in new business intake moderated to a 10-month low, reflecting competitive pressures and shifting consumer preferences toward online services. Subsectors such as finance and insurance continued to drive performance, supported by robust domestic demand. Selling price increases were the slowest in over two-and-a-half years, underscoring heightened competition, while employment growth remained steady as businesses anticipated future demand.

Together, the Manufacturing and Services PMIs highlight India’s strong domestic demand as a key driver of economic activity. However, softening international orders, rising input costs, and increasing competition present challenges that businesses will need to navigate strategically to sustain growth momentum.

Fiscal Developments

India’s fiscal position improved during the first half of FY2024-25, with key deficit indicators showing better performance compared to the same period last year. The gross fiscal deficit (GFD) stood at 29.4 percent of the budget estimate (BE), a marked improvement from 39.3 percent in the first half of FY2023-24. This improvement was primarily driven by robust revenue receipts, even as total government expenditure, estimated at approximately INR 21.10 lakh crore (USD 254.22 billion), remained flat year-on-year.

Revenue expenditure grew at a modest 4.2 percent during the first half, significantly slower than the 10 percent growth recorded in the same period last year. Capital expenditure contracted by 15.4 percent year-on-year in the first quarter, attributed to election-related spending restrictions under the model code of conduct and disruptions caused by heavy monsoon rains. However, the second quarter saw a recovery, with capital expenditure rising by 10.3 percent year-on-year. Subsidy allocations increased by 4 percent, driven by a sharp 27.6 percent rise in food subsidies, while fertilizer subsidies declined by 18.8 percent due to lower international fertilizer prices.

Gross tax revenues grew by 12 percent during April–September 2024, supported by strong income tax collections and goods and services tax (GST) revenues. Customs and excise duties also registered higher growth. Non-tax revenues surged by 50.9 percent, bolstered by a record surplus transfer of INR 2.10 lakh crore (approximately USD 25.30 billion) from the Reserve Bank of India. However, non-debt capital receipts declined by 27.6 percent due to lower disinvestment proceeds and loan recoveries.

The combination of disciplined expenditure management and robust revenue growth reflects the government’s efforts to maintain fiscal prudence while addressing growth and welfare priorities.

Trade and External Sector

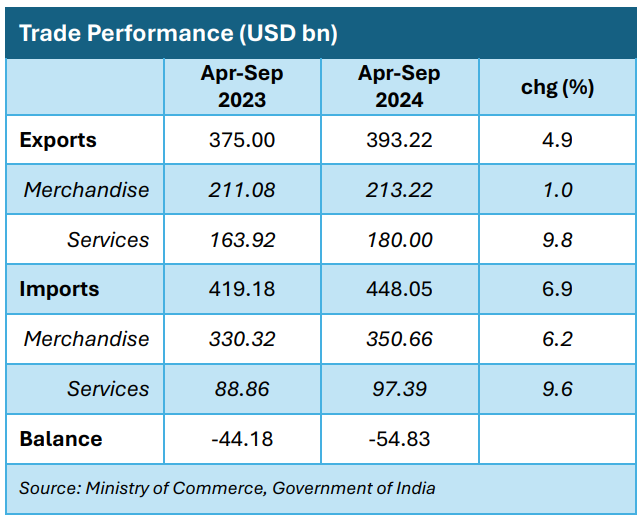

India’s trade performance in the first half of FY2024-25 reflected moderate export growth, a widening merchandise trade deficit, and a robust services trade surplus, underscoring the resilience of its services sector.

Total exports during April–September 2024 grew by 4.9 percent year-on-year to USD 393.22 billion, driven by merchandise exports of USD 213.22 billion (up 1.0 percent) and services exports of USD 180 billion (up 9.8 percent). Imports increased by 6.9 percent to USD 448.05 billion, comprising merchandise imports of USD 350.66 billion (up 6.2 percent) and services imports of USD 97.39 billion (up 9.6 percent). The merchandise trade deficit widened to USD 137.44 billion, compared to USD 119.24 billion a year ago, while the services trade surplus improved to USD 82.61 billion, providing a buEer against external pressures.

Non-petroleum and non-gems and jewelry exports rose by 5.9 percent to USD 162.77 billion, supported by strong growth in engineering goods, chemicals, plastics, and ready-made garments. Meanwhile, petroleum products, gems and jewelry, and marine products remained laggards. On the import side, demand for machinery, electronics, and non-ferrous metals drove non-petroleum and non-gems and jewelry imports, which increased by 5.4 percent to USD 222.72 billion. Petroleum products continued to dominate the merchandise trade deficit, highlighting India’s reliance on energy imports.

The services sector continued to be a strong pillar of trade, with exports growing nearly 10 percent to USD 180 billion. IT services and professional services remained key drivers, reflecting India’s competitiveness in these sectors. Services imports grew at a slower pace to USD 97.39 billion, resulting in a robust services trade surplus of USD 82.61 billion, a 10.1 percent improvement over the previous year.

Key export destinations during April–September 2024 included the Netherlands (up 36.7 percent from the same period last year), the UAE (up 11.5 percent), the United States (up 5.6 percent), Malaysia (up 27.9 percent), and the United Kingdom (up 12.4 percent). Imports rose from major sources including the UAE (up 52 percent from the same period last year), China (up 11.5 percent), Russia (up 5.7 percent), Taiwan (up 40 percent), and Oman (up 51.5 percent).

Investments

India’s investment inflows during the first half of FY2024-25 reflected robust foreign direct investment (FDI) growth alongside strong foreign portfolio investment (FPI) performance, particularly in equity markets.

Gross inward FDI surged by 25.7 percent year-on-year, reaching USD 42.10 billion during April– September 2024, compared to USD 33.50 billion a year ago. Key contributors to this growth were manufacturing, financial services, energy (including electricity), and communication services, which collectively accounted for about two-thirds of the total inflows. Major source countries included Singapore, Mauritius, the Netherlands, the UAE, and the United States, contributing approximately 75 percent of gross inflows. Despite the strong gross inflows, net FDI moderated slightly to USD 3.60 billion, down from USD 3.90 billion in the same period last year, due to increased repatriation and outward FDI activity.

Foreign Portfolio Investment (FPI) inflows witnessed a sharp uptick, with net inflows in September 2024 reaching USD 9.60 billion, the highest level since December 2020. Equity inflows stood at USD 5.90 billion, driven by favorable global factors, including a rate cut in the US, the unwinding of yen carry trade, and optimism surrounding India’s domestic growth prospects. Among emerging market peers, Indian equities attracted the second-highest inflows after China in September. The debt segment also continued to see steady inflows, with USD 23.50 billion since October 2023, following India’s inclusion in JP Morgan’s Government Bond Index – Emerging Markets (GBI-EM). Financial services and telecommunications emerged as the leading sectors for FPI inflows during September 2024. By mid-October (up to October 16), FPI activity saw net outflows of USD 7.90 billion, triggered by rising global risk aversion. This reflects the growing volatility in global financial markets and underscores the need to monitor external headwinds that could aEect portfolio flows in the near term.

India’s investment landscape highlights strong FDI momentum in key sectors and the continued attractiveness of Indian assets to global investors. However, external factors such as global monetary policy shifts and geopolitical uncertainties remain critical in shaping investment trends moving forward.

Foreign Exchange Reserves and Exchange Rate

India’s foreign exchange reserves peaked at USD 704.90 billion on September 27, 2024, before moderating to USD 690.40 billion by mid-October. These reserves provide 11.8 months of import cover and exceed 101 percent of the country’s total external debt as of end-June 2024. Year-to-date, reserves have increased by USD 68 billion, making India the second-largest accumulator of foreign reserves after China.

The Indian rupee remained one of the least volatile currencies globally, with an average exchange rate of 83.79 in September 2024. Month-on-month, the INR depreciated marginally by 0.1 percent. In real eEective exchange rate (REER) terms, the rupee depreciated by 0.3 percent, reflecting nominal depreciation oEset by favorable price diEerentials.

India’s trade and external sector performance underscores the importance of services exports and targeted merchandise export growth in oEsetting the pressures of a widening trade deficit. Continued diversification of export markets and products will be critical to maintaining external stability amidst global uncertainties.

Economic Outlook for the Second Half of FY2024-25

India’s economy is expected to maintain robust growth in the second half of FY2024-25, driven by strong domestic demand, improved agricultural output, and continued investment activity. The RBI anticipates real GDP growth to reach 7.6 percent in Q3 FY2024-25, supported by festive season spending, a favorable kharif harvest, and resilient infrastructure investments. Analysts project this momentum will extend into Q4, further reinforcing the country’s positive economic trajectory.

Private consumption is likely to remain the key driver of growth, buoyed by rural demand, enhanced purchasing power from a good harvest, and sustained consumer confidence. The investment environment remains favorable, with high-capacity utilization, robust credit growth, and government-led infrastructure initiatives fueling activity. Services exports, particularly IT and professional services, are expected to perform strongly, while merchandise exports may face headwinds from global economic uncertainties and muted demand in key markets. Import growth is anticipated to remain elevated, reflecting continued domestic industrial and consumer demand.

Inflation pressures, particularly food-related, are expected to moderate by Q4 as fresh supplies from the kharif harvest enter the market. The RBI forecasts inflation for FY2024-25 at approximately 4.5 percent, with risks balanced. However, the volatility in global crude oil and commodity prices could pose challenges, necessitating close monitoring of price movements.

India’s fiscal position is expected to remain stable, with continued buoyancy in tax revenues— particularly GST and income tax—supporting expenditure priorities. This stability, alongside disciplined fiscal management, is likely to ensure that the fiscal deficit remains within target levels.

On the external front, India’s foreign exchange reserves, which stood at USD 690.40 billion in midOctober, provide a strong buEer against external shocks. The services trade surplus and steady remittance inflows are expected to help oEset pressures from the widening merchandise trade deficit. The Indian rupee is projected to maintain relative stability, supported by strong external indicators and investor confidence.

While the economic outlook is positive, several risks remain. These risks include potential adverse weather aEecting rabi crop yields, geopolitical tensions impacting global trade and energy prices, and rising input costs that could weigh on industrial activity. Policymakers must remain vigilant to mitigate these risks and sustain economic momentum.

India’s economic prospects for the second half of FY2024-25 are characterized by strong domestic drivers, a stable fiscal position, and resilience in the external sector. Continued policy support and proactive risk management will be essential to navigating uncertainties while ensuring sustained growth and stability.

Policy Recommendations

- Monetary Policy: The RBI may consider maintaining its current neutral stance while closely monitoring inflation trends. Adopting a flexible approach to interest rate adjustments could help balance price stability with economic growth, especially in response to fluctuating food prices and global commodity volatility.

- Fiscal Policy: Continuing to prioritize capital expenditure in infrastructure, renewable energy, and rural development could support sustained growth and job creation. Enhancing public investment in these areas may encourage private sector participation and stimulate broader economic activity, while maintaining fiscal discipline through eEicient expenditure and revenue mobilization ensures long-term fiscal health. Agricultural and

- Rural Development: Enhancing support for the agricultural sector through investments in irrigation, storage, and technology adoption might improve productivity and resilience against climate-related risks. Strengthening crop insurance schemes and expanding access to credit for farmers could help stabilize food prices and promote inclusive growth in rural areas, thereby reducing inflationary pressures and enhancing food security. External

- Sector Management: Maintaining adequate foreign exchange reserves and monitoring external debt levels could help safeguard against external shocks and currency volatility. Diversifying export markets and promoting high-value-added exports may enhance competitiveness and mitigate trade deficits, while facilitating FDI inflows in growth sectors can support external financing needs and foster technology transfer and employment. Structural Reforms and

- Investment Climate: Advancing reforms in labor laws, land acquisition, and the ease of doing business could boost productivity and attract more domestic and foreign investment. Emphasizing digital infrastructure and innovation, particularly in technology, manufacturing, and services sectors, may unlock new growth opportunities, while streamlining regulatory processes and strengthening legal frameworks can further improve the investment environment and support sustainable long-term economic growth.

In Focus: Bond Markets in India

The bond market in India plays a pivotal role in the nation’s financial system and economic growth. As an expanding economy requiring substantial capital and resources to achieve industrial and financial advancement, India relies heavily on a dynamic and robust debt market to meet its increasing resource demands. Over the past decade, the Indian economy has maintained an average growth rate of approximately 6.5 percent annually and is poised for even higher growth in the next five years. A well-functioning bond market is essential to support this trajectory by providing a reliable avenue for funding, facilitating monetary policy implementation, and offering investors opportunities for risk-adjusted returns.

Economic Role and Significance of Bonds in India

Bonds are fundamental to the Indian economy for several reasons. They provide essential funding for infrastructure projects such as roads, bridges, and hospitals, which are vital for economic development. By offering an alternative to traditional bank loans, bonds help spread financial risk across different sectors of the economy. Bond yields reflect changes in interest rates, thereby enhancing the effectiveness of monetary policy. Moreover, bonds offer predictable returns, making them an attractive investment option for investors seeking stable income. They also assist insurance companies and pension funds in managing their long-term liabilities more effectively. Additionally, the bond market encourages prudent fiscal management and sustainable policies for governments by providing a market-based assessment of fiscal measures.

RBI Initiatives for Bond Market Reforms

Recognizing the critical economic role bonds play, the Reserve Bank of India (RBI) has actively promoted bond market reforms. The RBI has implemented several initiatives to enhance the efficiency, transparency, and inclusivity of India’s bond market. The introduction of improved trading platforms like the Negotiated Dealing System-Order Matching (NDS-OM) for government securities has enhanced trading efficiency. Efforts have been made to reduce trading costs and standardize reporting requirements, making bond trading more accessible and transparent. The RBI is encouraging participation from a broad range of investors, including foreign investors, by relaxing investment rules and improving market access. The use of tools like Open Market Operations (OMOs) helps manage liquidity and interest rates, supporting market stability. Furthermore, the RBI is increasing awareness of the bond market among retail investors through educational programs, aiming to boost participation and diversify the investor base, thereby further strengthening the market.

Growth of the Corporate Bond Market

India’s corporate bond market has experienced a remarkable transformation in the fiscal year 2023- 24, with a record mobilization of INR 997,804 crore (approximately USD 1.20 trillion) through private placements. This marks an impressive 17 percent increase compared to the previous year, signaling robust growth in corporate debt issuance. A total of 976 institutions and corporations contributed to this achievement, underscoring the wide-ranging participation and demand across various sectors. The deals included in this mobilization encompass both listed and unlisted bonds with a tenor and put/call option exceeding 365 days, reflecting a preference for longer-term financing solutions.

The growth of the corporate bond market is a clear indication of India’s expanding capital markets and the increasing confidence of investors in corporate debt as a viable asset class. This growth is further bolstered by favorable regulatory changes, improved market infrastructure, and a strong economic outlook. The corporate bond market has become an essential tool for businesses to raise capital at competitive rates while offering investors opportunities for diversification and attractive returns. As corporate bonds continue to gain traction among both issuers and investors, the market is poised for even greater expansion in the coming years, playing a key role in India’s economic growth and development.

Current Outlook on the Indian Debt Market

Foreign Portfolio Investors (FPIs) have significantly increased their investments in the Indian debt market in 2024, with net inflows surpassing the INR 1 lakh crore (approximately USD 1.20 billion) mark. According to data from the National Securities Depository Limited (NSDL), FPIs have invested a substantial INR 1,02,354 crore (approximately USD 1.23 billion) in the Indian debt market so far this year.

In August alone, FPIs invested INR 11,366 crore (approximately USD 137 million), following net investments of INR 22,363 crore (approximately USD 269 million) in July, INR 14,955 crore (approximately USD 180 million) in June, and INR 8,760 crore (approximately USD 105 million) in May. While the debt market has seen robust inflows, FPIs have pulled out INR 16,305 crore (approximately USD 196 million) from Indian equities this month, driven by factors such as the unwinding of the yen carry trade, recession fears in the US, and ongoing geopolitical conflicts in the Middle East. Despite these outflows, FPI inflows into the equity segment in 2024 so far stand at INR 19,261 crore (approximately USD 232 million).

Analysts attribute the strong FPI activity in the debt market to the anticipation and subsequent inclusion of India in global bond indices, announced in October 2023. This inclusion has led to frontloading of investments, with FPIs maintaining a steady momentum even after the announcement. The Indian regulator is also considering regulatory tweaks to permit certain FPIs to invest more than the existing 10 percent cap in equity by harmonizing the FDI and FPI routes. Overall, the Indian debt market has benefited from substantial FPI inflows, reflecting strong investor confidence and positioning India as a key destination for global investments in both debt and equity markets.

Challenges and Opportunities in the Indian Bond Market

Despite the positive developments, the Indian bond market faces several challenges. The corporate bond market suffers from low liquidity, making it difficult for investors to buy and sell bonds without significantly affecting prices. Navigating the complex regulatory framework can be challenging for both issuers and investors, potentially hindering market growth. Credit risk, particularly for lowerrated corporate bonds, remains a significant concern. Additionally, many retail investors are not fully aware of the benefits and opportunities in the bond market, leading to limited participation.

However, there are substantial opportunities that can be capitalized upon. Government initiatives in infrastructure development are creating a substantial demand for long-term capital, making bonds an attractive investment option. Bonds offer an excellent way to diversify investment portfolios beyond stocks, reducing overall risk and enhancing returns. The increasing participation of institutions in the bond market is gradually improving liquidity, making it easier for investors to trade bonds. Advances in technology are making bond investments more accessible and transparent; improved trading platforms and digital tools are simplifying the investment process, attracting more investors to the market.

By addressing these challenges and capitalizing on the opportunities, the Indian bond market can play a more significant role in the country’s economic development and provide investors with valuable investment avenues.

Impact on the Financial System and Economic Growth

The government securities market, also known as the ‘G-Sec’ market, is the largest and oldest segment of the Indian debt market, considering market capitalization, outstanding securities, and trading volumes. This market is fundamental to the Indian economy as it sets the benchmark for interest rates through the yields on government securities, which are considered the risk-free rate of return in any economy.

In addition to the G-Sec market, India benefits from an active corporate debt market, which includes both short-term instruments such as commercial papers and certificates of deposit, as well as longterm instruments like debentures, bonds, and zero-coupon bonds. These markets help in channeling funds from investors to businesses, enabling companies to raise capital for expansion, working capital, and other financial needs. The ability to trade in a variety of debt instruments allows for greater liquidity and flexibility, contributing to the overall health and efficiency of the financial system.

The debt market, therefore, not only supports the growth of businesses but also fosters stability in the broader economy. It provides a reliable avenue for funding, facilitates monetary policy implementation, and offers investors opportunities for risk-adjusted returns. As India continues its path of economic growth, the bond market will play an increasingly important role in meeting the nation’s capital requirements and supporting sustainable development.

This report is intended for informational purposes only and does not constitute investment advice. Readers are encouraged to seek professional advice before making any investment decisions.

Sources

- Business Standard. (2024, April 19). Corporate bond market booms: Record high mobilization despite tax changes.

- Business Standard. (2024, September 26). India’s private debt market to top $18 bn in 2024 as economy grows: Report.

- Economic Times. (2024, November 20). India’s Q2 economic growth likely took a hit from heavy rains and corporate struggles: ICRA.

- Federal Reserve Bank of St. Louis. (2024). India/US exchange rate (EXINUS).

- Livemint. (2024, August 26). FPI inflows in Indian debt market cross ₹1 lakh crore mark in 2024 so far.

- Livemint. (2024, November 14). Multibagger Stock: PTC Industries surges over 275% in 2 years, achieves 3,200% growth in 4 years.

- Ministry of Commerce and Industry, Government of India. (2024, October 16). Trade data: September 2024 [Press release].

- Ministry of Statistics and Programme Implementation, Government of India. (2024, November 12). Consumer price index (CPI) [Press release].

- NSE India. (2024). Market Watch – CBRICS.

- Observer Research Foundation. (2024, June 10). ₹10K apiece: Will corporate bonds matter now in India?

- Reserve Bank of India (RBI). (2024, October 9). Monetary Policy Statement, 2024-25. Resolution of the Monetary Policy Committee (MPC) October 7 to 9, 2024 [Press release].

- Reserve Bank of India. (2024, November 20). Select Economic Indicators.

- Reserve Bank of India. (2024, October 19). Select Economic Indicators.

- Reserve Bank of India. (2024). Monetary policy statement (October 7-9).

- Reserve Bank of India. (2024). October bulletin.

- S&P Global. (2024, October 1). HSBC India Manufacturing PMI [Press release].

- S&P Global. (2024, October 4). HSBC India Services PMI [Press release].

- The Fixed Income. (2024, May 9). A Quick Summary of The Indian Debt Market.

- Vested Finance. (2024, August 5). India’s Bond Market: Size, Structure, Growth, and Opportunities.