February 17, 2023 | New Delhi

February 17, 2023 | New Delhi

February 16, 2023 | New Delhi

February 12, 2023 | New Delhi

February 10, 2023 | New Delhi

February 7, 2023 | New Delhi

January 19, 2023 | New Delhi

January 17, 2023 | New Delhi

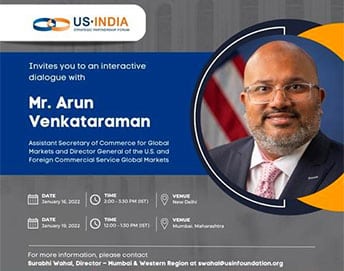

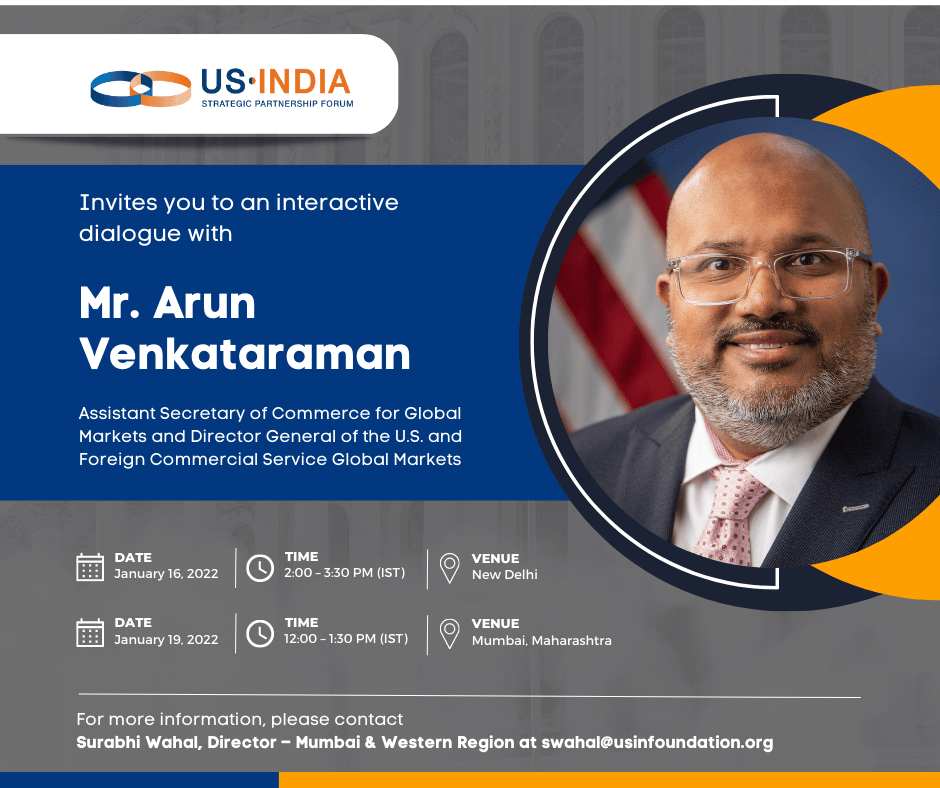

January 16, 2023 | New Delhi

December 15, 2022 | New Delhi

December 13, 2022 | New Delhi

December 8, 2022 | New Delhi

December 8, 2022 | New Delhi

December 8, 2022 | New Delhi

December 8, 2022 | New Delhi

December 8, 2022 | Bengaluru

November 23, 2022 | New Delhi

November 2, 2022 | New Delhi

October 26, 2022 | New Delhi

October 18, 2022 | Gandhinagar

October 14, 2022 | Haryana

October 14, 2022 | New Delhi

October 12, 2022 | New Delhi

October 10, 2022 | New Delhi

October 10, 2022 | Mumbai

October 6, 2022 | New Delhi

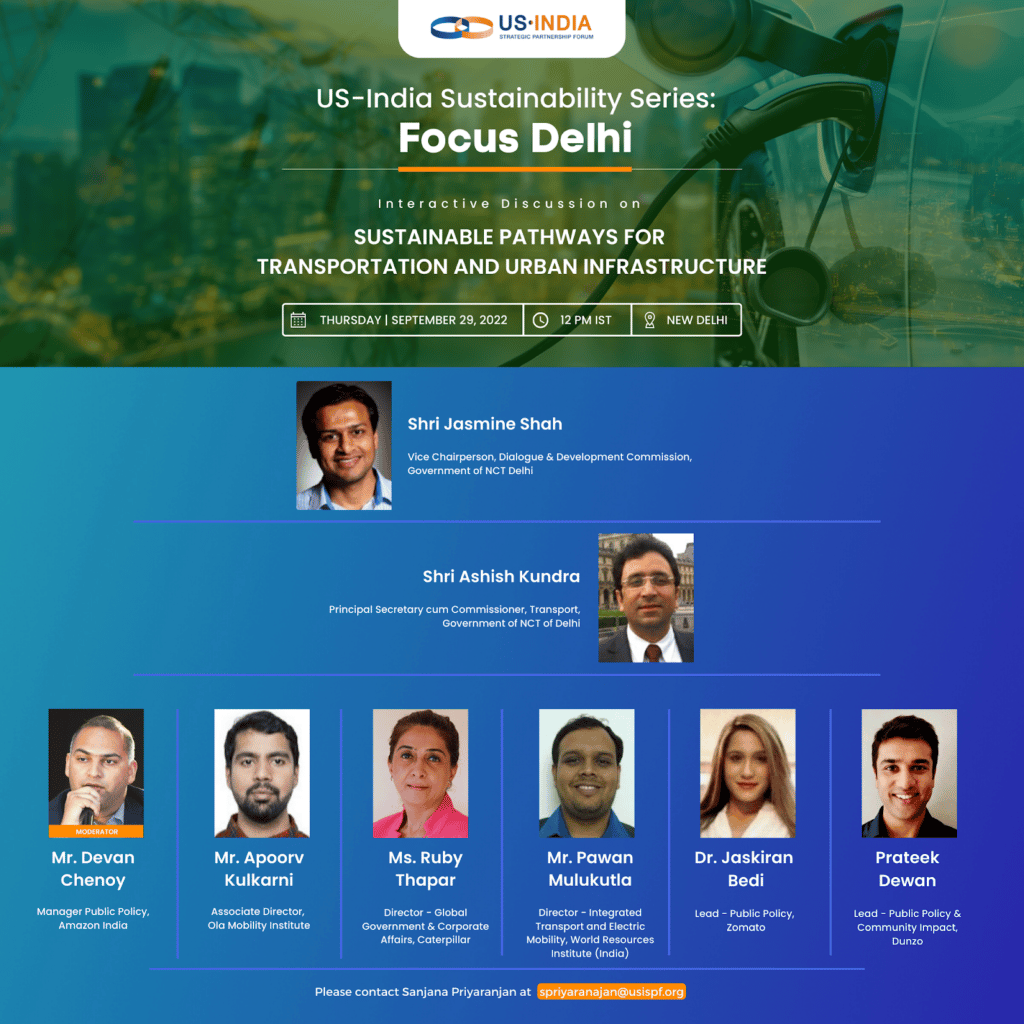

September 29, 2022 | New Delhi

September 19, 2022 | New Delhi

August 23, 2022 | Madhya Pradesh

August 22, 2022 | New Delhi

July 4, 2022 | Gandhinagar

December 8, 2021 | New Delhi

USISPF hosted Finance Minister Nirmala Sitharaman for a series of one-on-one interactions and roundtable meetings with investors in Boston, New York City, and Washington, DC. The strong participation was a sign of the ongoing interest in India as a potential investment destination, including for manufacturers seeking to diversify their global supply chains.

Finance Minister Sitharaman took the opportunity to inform U.S. investors about India’s post-pandemic economic rebound and new incentive programs in place to facilitate foreign investment, and to hear from participants about various policy and regulatory challenges still to be addressed in the country. In her remarks, the Minister discussed the ways tech-enabled systems had enabled people to survive during the worst of the pandemic by using digital means to collect direct financial support, conduct government transactions, and receive critical market information. She outlined the budget measures taken to boost the recovery, highlighting reforms in insurance, banking, capital market regulation, and privatization.

Many of the participants spoke of large current investments in India and plans for substantially more, particularly if the government’s privatization and asset monetization plans move forward quickly. Several also said they are looking to incorporate India more fully into their global supply chains. They commended the pace of reform to date and urged the Minister to work with partners to increase regulatory consistency and transparency throughout the economy. Several also expressed concern about productivity losses from data localization and urged the government to consider a safe harbor policy for data with the United States.

Investors agreed India would benefit from measures to deepen its domestic capital markets and reduce the costs of debt and equity financing in the country. Reducing the size of public sector holdings in the financial sector is a critical first step. Other concrete measures include making it easier for foreign investors to register as Qualified Foreign Institutional Investors (QFII) in the country and to hedge their currency risks. They noted additional incentives and support for public private partnerships would support the government’s ambitious infrastructure investment goals.

On the issue of climate, several participants expressed eagerness to help finance India’s transition to a green economy, while the Minister noted India’s deep commitment to the issue, it being one of only a handful of countries to have met its climate goals.

All participants agreed the U.S.-India financial partnership is strong and will benefit from further tangible successes. They remain committed to working together on these issues to support India’s economic recovery and boost economic growth, jobs, and investment.

November 30, 2021 | New Delhi

The second wave of COVID-19 in India led to a pause in high-level engagements between the United States and India. However, US efforts to support and assist India in its battle against the pandemic took forefront and both sides witnessed an unprecedented cooperation on the healthcare front. It is expected that healthcare cooperation between the two countries will continue both bilaterally as well on multilateral platforms like the Quad and the UN General Assembly.

After a successful trip by U.S. Secretary of Defense Lloyd Austin to India in March, and India External Affairs Minister S. Jaishankar’s recent trip to Washington, D.C., working level engagements have begun for the next round of the 2+2 Dialogue expected to be hosted in October in Washington D.C.

Both sides are working on a potential agenda, although it is unlikely that any high-level deliverables will be announced. Additionally, U.S. Trade Representative Katherine Tai remains engaged with her counterpart, Ministry for Commerce and Industry Piyush Goyal. While there is less likelihood that the stalled mini trade deal under the Trump administration will be addressed, a prospective broader trade deal with additional components is under discussion. The U.S.-India Trade Policy Forum has not convened since 2017. However, both USTR Tai and Minister Goyal are committed to holding the TPF and the CEO Forum this year.

On the defense relationship, the next round of the U.S.-India Defense Technology and Trade Initiative (DTTI) and a visit by officials of the Indian Defense Acquisition Council is also likely to take place in the coming months. On the energy and climate change front, U.S. Special Envoy on Climate Change John Kerry undertook a visit to India and met with the leadership to deepen ties and efforts on tackling climate change. Both sides are committed to remaining engaged on the issue and more high-level interactions are expected to take place.

June 9, 2021

April 21, 2021 | New Delhi

The US-India Strategic Partnership Forum in partnership with NITI Aayog announced the launch of its adult immunization initiative “Immunization: Pulse of a Resilient Public Health System”. This timely initiative aims to create a platform to initiate a dialogue among key stakeholders on the role and importance of creating a resilient public health system through immunization among adults.

Despite being one of the top ten public health interventions, vaccines are typically synoynyms with pregrnant women, infants and children. In reality reality far too many adults fall ill or die each year from diseases that can either be prevented by vaccines or the risk can be mitigated. Additionally, there are no national adult immunization guidelines in India, therefore making it unclear as to who should receive certain vaccines among adults. USISPF’s initiative will help India strengthen its vaccine delivery programme towards adults through the following objectives:

Through this initiative USISPF plans to host a series of discussions on issues pertaining to healthy ageing, vulnerable groups, vaccinating workforce, protecting healthcare workers as well as at-risk groups, among others.

To kick off the initiative, USISPF hosted a virtual roundtable on April 16, 2021 with senior government and industry leaders including –

The Launch saw the participation of over 400 people from various sectors such as Government, Media, NGOs, Public health experts, Industry representatives, Economists, Academia, among others. Discussions focused on vaccine delivery mechanism, in light of the current global health crisis; highlight the need for public and private sector intervention towards immunizing adults to reduce the burden on public health infrastructure; overcoming regulatory challenges to incentivize immunization of adult population.

Dr Mukesh Aghi, President and CEO US India Strategic Partnership Forum welcomed the speakers and participants. Dr. Aghi laid special emphasis on replicating India’s success in polio eradication to reduce burden of VPDs in adult population. Dr Manohar Agnani explained the robustness of India’s vaccine ecosystem and its readiness to support immunization of large population for any future interventions if they are cost effective and for the public good. He also endorsed the recommendation of Prof. Srinath Reddy on the need for robust, responsive and timely surveillance system through epidemiological surveys on deaths, diseases and burden to be able to measure current and anticipate future disease burden to support timely measures. Prof N K Ganguly recommended immunization of elderly with co-morbidities like COPD, diabetes, hypertension, acute kidney ailments etc by saying that vaccination will be a savior to such population. He also emphasized on the need for strong collaboration between public and private sector to create sustainable financial architecture to ensure equitable distribution of vaccines to adult population from various economic sections of our society.

Speakers representing industries deliberated on leveraging infrastructure created during ongoing pandemic for immunizing adults against many other high burden VPDs, role of private sector partnership on mass awareness among healthcare workers and larger population on various VPDs common among adults especially high-risk population with co-morbid conditions. Dr Srirupa Das proposed a way forward for private sector partnership on disease surveillance and monitoring by offering strong pharmacovigilance system available with pharma companies. Dr Sanjay Singh, CEO, Gennova Biopharmaceuticals emphasized on the need for creation of National Advisory Group by the Government of India to develop standard guidelines on Adult Immunization.

Dr Arindam Ray from BMGF endorsed the need for a strong disease monitoring system to prioritize immunizing adults. Dr Ray also informed about BMGF future initiatives on enhancing HPV vaccine coverage among adolescent girls through school programme under RBSY scheme which is part of Ayushman Bharat-PMJAY.

December 1, 2020 | Punjab

On November 17 and 18, USISPF hosted the U.S.-Punjab Investor Summit Roundtable Series. In the inaugural session, the Chief Minister of the Government of Punjab, Captain Amarinder Singh, spoke about the growing potential for investors in Punjab and the significant contributions that the state had been consistently making to India’s growth and development over the last few decades. He also proudly spoke about the farmers of Punjab, and the steps that the government was taking to ensure that their livelihoods would be aptly protected. Taranjit Sindu, Ambassador of India to the U.S., further mentioned that India had proven itself to be a reliable partner and friend in the terms of reform, resilience, and recovery to corporations in the global arena. Referring to the recent developments regarding the COVID-19 vaccine, he was certain that Punjab would lead the manufacturing of the vaccine which will be undoubtedly crucial for its quick distribution. Chief Secretary, Vini Mahajan, added that Punjab has successfully created an ecosystem that provides the kind of setup that corporate leaders are looking for.

Praising the state of Punjab as the “Foodbowl of India,” Ajay Banga, the CEO of Mastercard, stated that doing business in the state of Punjab was “Sacha Sauda,” or a true bargain. He reassured investors that Punjab was the start-up hub of the country and that its growth story makes it an attractive destination for investments. He also recognized the potential for the use of Artificial Intelligence and Machine Learning to support development across agriculture, supply chain manufacturing, health and education. Touching upon the issue of education during the time of the pandemic, he commended the outstanding work that the state of Punjab had done to make their public school a true model of learning for the students. Despite challenges being posed by the pandemic, he said, Punjab continues to attract investors. Currently, 30+ American firms are based in Punjab, assisting the state to become a part of global supply chains. Lastly, Alok Shekhar, Principal Secretary of the Government of Punjab brought to attention some key points on the importance of businesses across the globe collaborating for mutual benefit in Punjab.

At the Food and Agriculture Roundtable, USISPF hosted Anirudh Tewari, Additional Chief Secretary, Development of Horticulture, who spoke on the impressive contribution of the state to the total food and vegetables production of the country. He also added that Punjab was on track to becoming the seed production hub of the country. Ambassador Taranjit Sindhu further announced that Punjab and the United States could explore complementarities in a range of sectors including agriculture, food processing, education, textile, garment, renewable energy, light engineering, pharma and IT. Rajat Agarwal, CEO of Invest Punjab, cited the importance of ensuring food security in the nation, a task that the state of Punjab had actively undertaken. He stressed the huge potential for pharma and medical apparatus companies to set up their manufacturing units in Punjab, especially in the midst of the exponential expansion of the pharma landscape in the state. He further shared the recent developments made in the state-of-the-art facilities at the upcoming Bulk Drug/Pharma Park at Bathinda and Wazirabad.

After a successful first day, the U.S.-Punjab Investor Roundtable Series convened again for a conversation with Alok Shekhar, Principal Secretary of Department of Industries and Commerce at the Government of India. Alok Shekhar expanded on the opportunity for investments in GD engineering, bicycle manufacturing, and the demand for precision engineering. He added that there were 250+ registered IT units in Punjab, which is also home to big names like Infosys, Fidelity, Bunge, FIS, Emerson, Meritech, and Quark. Rajat Agarwal, CEO of Invest Punjab, agreed with the general consensus and mentioned that private industry partners were contributing to the infrastructure and industry partners were coming in with their trainers, a move that was sure to improve infrastructure in the state. He presented the major investment opportunities in engineering and manufacturing in the state in key areas including Railway Coach Manufacturing, Heavy Engineering, Precision Engineering, and Automobile OEMs. He also lauded Mohali’s position as the IT and startup destination of Punjab that offers more than 1.5 million sq ft ready to move “Plug and Play” facilities in STPI, Quark City, Bestech, and more.

In the concluding event of the series, Rahul Bhandari, Secretary of the Department of Higher Education and Languages in the Government of India, spoke about the 260+ million students currently studying in educational institutions in Punjab. There were representatives from more than 30 educational institutions from the U.S. present at the event who participated in a collaborative and energetic discussion on the exploration of future opportunities for higher education collaboration between India and the U.S.

November 8, 2020 | New Delhi

On July 24, USISPF and HSBC collaboratively hosted a webinar on “Global Supply chain Opportunities in India,” featuring NITI Aayog CEO Amitabh Kant, Invest India Managing Director and CEO Deepak Bagla, and USISPF President and CEO, Mukesh Aghi.

In his opening statements, Dr. Mukesh Aghi highlighted the shift in U.S. businesses towards a “China plus one” strategy and investment in high ESG (environmental, social, and governance) geographies. He also pointed to the energy and pharmaceutical sectors as areas where U.S. companies are interested in investing in India.

Amitabh Kant, CEO of think tank NITI Aayog, spoke on the opportunities for India to become a global manufacturing hub, as COVID-19 has accelerated a trend towards diversifying global supply chains. Although other countries have benefited from U.S. companies seeking alternatives to China-based supply chains, he argued that India is the only sustainable option in the long term, since it has the “capability for large-scale production of export-ready goods and a large-scale domestic market.” He also highlighted the efforts of the Government of India to enact reforms on the ease of doing business and opening automatic-route foreign direct investment (FDI) across sectors, and to pursue a strategy of “make in India for the world.”

Deepak Bagla, Managing Director and CEO of Invest India, spoke on India’s goal of achieving a $5 trillion economy by 2025 and its advantage as an investment destination. He provided insight into Government of India initiatives such as the Empowered Group of Secretaries and project development cells, as well as state-level reforms and ‘single window’ processes to improve the experience of setting up business in India. He also spoke on the “cluster approach” and shortening of supply chains, in response to which India has developed a “plug and play” model for industrial clusters and industrial townships.

April 28, 2022| New Delhi

On July 28, USISPF hosted a virtual roundtable on the current state of the Indian distressed market and related investment opportunities. Featured speakers included Ambassador Frank Wisner, International Affairs Advisor at Squire Patton Boggs; Sunil Mehta, former chairman of Punjab National Bank and currently, the non-executive chairman of Yes Bank; and Cyril Shroff, Managing Partner of Cyril Amarchand Mangaldas, as well as L Viswanathan and Dhananjay Kumar from Cyril Amarchand Mangaldas. Stephen Lerner, Global Chair of the Restructuring and Insolvency Practice Group at Squire Patton Boggs, moderated a panel discussion in which the speakers shared their insight on alternative mechanisms for insolvency and bankruptcy resolution, and opportunities these present for U.S. investors in India.

In his opening statements, Ambassador Wisner characterized distressed assets as “storehouses of great value and platforms for future growth,” and said that opportunities to restructure and refinance distressed assets in India could be a “fruitful endeavor” for U.S.-India cooperation.

Sunil Mehta discussed the improvements to India’s insolvency and bankruptcy policies since the creation of the Insolvency and Bankruptcy Code, 2016 (IBC) as well as some challenges that remain, particularly in light of the COVID-19 pandemic. He highlighted pre-packaged solutions, one-time restructuring, and asset reconstruction companies as potential resolution platforms that are being considered as alternatives to the IBC. Finally, he discussed the success of the bank-led resolution structure in the case of Yes Bank, which has been able to raise $2 million in capital through its public offering earlier this month.

Cyril Shroff also discussed the importance of the IBC, saying that the stressed assets environment has changed significantly as a result of having a rules-based system for resolution according to global best practices, and that its success has been supported by proactive legislative and executive action, as well as landmark judgements by the Supreme Court of India. While noting that the government’s decision to suspend the IBC in March was an appropriate policy response at that stage, he warned that the suspension may be abused by companies whose financial difficulties are not due to COVID- 19. Looking to the future, he predicts flexibility and open-mindedness on legislative reforms, new vehicles for private capital, meaningful action on pre-packaged regime, notification of a model code for cross-border insolvency, and a financial sector resolution code.

November 8, 2020 | Delhi

On July 16, USISPF hosted a virtual roundtable with Ambassador Nicholas Burns, senior counselor at the Cohen Group and former U.S. Under Secretary of State for Political Affairs. Speaking with members of USISPF’s Board of Directors, Ambassador Burns shared his insights on the shifts in the U.S.’s foreign policy frameworks, the role of global institutions in the post-COVID world, and the importance of deepening U.S.-India relations.

Speaking with USISPF President and CEO Mukesh Aghi, Ambassador Burns outlined the challenges faced by the U.S. and India as a result of the ongoing pandemic, global economic crisis, and the actions of an increasingly aggressive China. He emphasized the importance of the U.S.-India relationship to addressing these challenges, both in a bilateral and multilateral context.

During a period of discussion with USISPF’s Board of Directors and other participants, discussion focused on U.S.-India relations in the context of broader regional dynamics and opportunities for defense and economic cooperation with Japan and Australia through the ‘Quad’ framework.

Ambassador Burns also assessed the impact of turning points in the bilateral relationship, such as the Civil Nuclear Deal and 2017 declaration of strategic defense partner status.

November 8, 2020 | Virtual

On May 12, Rahul Ghosh, Senior Vice President of Global Emerging Markets, Credit Strategy & Research, at Moody’s, joined USISPF members on a webinar to share high-level views on the credit outlook of emerging markets.

Overall, Mr. Ghosh highlighted that the pandemic’s economic and financial fallout will heighten credit risks for emerging market issuers. While external and fiscal buffers vary across regions, low-rated sovereigns with large external repayments are most vulnerable to prolonged stress. Additionally, the fallout from the pandemic will increase the corporate default rate in emerging markets over the coming year. Finally, he noted that future challenges, as the world recovers from COVID-19, include lower rates and higher government debt, changing consumer habits, climate risks, protectionism, tech disruption, and income inequality.

His presentation focused on emerging markets more broadly, but during the Q&A session with USISPF members, Mr. Ghosh evaluated India’s ongoing fiscal response to the economic impact of COVID-19, including the RBI’s measures to increase liquidity, as well as some proposed or hypothetical steps the Government of India could take in the future. He also provided his insight on the impact the current global economic challenges could have on India’s banking and non-banking financial company (NBFC) sectors.

November 8, 2020 | Delhi

On May 5, Javier Piedra, Deputy Assistant Administrator of the Bureau for Asia, USAID, and Ramona El Hamzaoui, Deputy Mission Director for India, USAID, joined USISPF members on a webinar to discuss USAID’s COVID-19 response in India. Other colleagues from USAID were also on the webinar including Public Health Program Specialist Sangita Patel and Nahel Sanghavi, Senior Advisor for Innovation & Partnership, to share insights into efforts related to their specific expertise.

Javier Piedra began the discussion by highlighting that, since the outbreak of COVID-19, the U.S. government has committed more than $775 million to aid in more than 120 countries. In India, he pointed to the importance of addressing ‘second order effects’ of COVID-19, such as supply chain issues, as well as its immediate impact.

Ms. El Hamzaoui spoke on shift in USAID’s relationship with India, highlighting the agency’s current partnership-based initiatives to support not just India’s development but India’s role in the region and globally. So far, to address COVID-19 in India, USAID has provided $6 million in aid to support the Government of India’s response efforts. Interagency teams have supported initiatives ranging from helping female textile workers shift to mask production to training health care workers in contact tracing. USAID has also been assisting with initiatives to ensure that other health issues are not ignored during the COVID-19 crisis, from developing an app to support mother and infant health to facilitating the export of vital HIV/AIDS medication from India to Laos.

During a Q&A period with USISPF members moderated by USISPF Senior Advisor Vikram J. Singh, Ms. El Hamzaoui, Mr. Piedra, Ms. Patel, and Mr. Sanghavi spoke on topics ranging from India’s health care infrastructure and medical supply and pharmaceutical industries, to innovative solutions from the Indian technology sector and the CSR contributions of private-sector partners.